Bitcoin (BTC) surged to a new all-time high (ATH) today, smashing past its previous $$73,750 peak set in March earlier this year.

Currently trading at $74,231, Bitcoin is pushing ever closer to the highly anticipated $100,000 milestone as Donald Trump leads Kamala Harris in early trends at the time of writing.

Historical Context of Bitcoin All-Time Highs

Bitcoin’s last ATH occurred in mid-March 2024, peaking at $73,686.93.

Back then, the market was fueled by bullish sentiment, sparked by the approval of spot Bitcoin ETFs and a surge in institutional interest

However, the subsequent months saw a sharp decline in prices, primarily due to regulatory concerns, macroeconomic factors, and increased market volatility.

Before the 2024 Bitcoin ATH, the top crypto set major records in 2021, starting the year around $29,000 and quickly breaking the $60,000 mark by mid-April.

Bitcoin reached a peak of $64,895 on April 14, 2021, before hitting another all-time high of $69,000 on November 10, 2021.

Prior to this, the previous record was set in 2017, when BTC’s price surged to $19,188 on December 16.

Bitcoin’s first major milestone, however, came in November 2013, when it crossed the $1,000 mark for the first time.

What’s Fueling Bitcoin’s Latest Rally?

The recent surge in Bitcoin’s price can be attributed to multiple factors.

For one, the influx of institutional investment has played a crucial role, with major firms increasing their BTC holdings.

For instance, Japanese investment firm Metaplanet has emerged as a major Bitcoin buyer this cycle, bringing its total BTC holdings to 1,018.17 BTC, valued at roughly $68.8 million, with the latest purchase.

Furthermore, current investor sentiment appears to lean towards optimism, as reflected in the Fear and Greed Index, which has shifted towards the “Extreme Greed” zone.

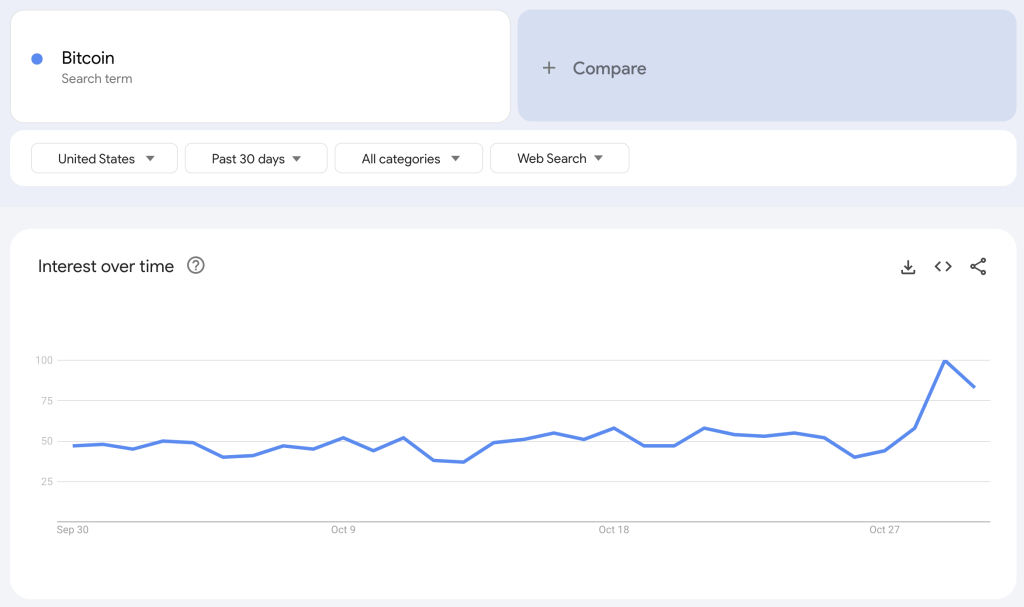

Google search trends for Bitcoin have also surged, indicating a rising interest among retail investors.

Meanwhile, according to Bitfinex analysts, the rally is largely fueled by the possibility of a Trump victory in the U.S. presidential election and seasonally bullish market conditions.

Analysts describe the current setup as unique, with the convergence of “election uncertainty, the ‘Trump trade’ narrative, and favorable Q4 seasonality” driving Bitcoin’s bullish momentum.

Specifically, the analysts said there is a growing “Trump trade” narrative, pointing out that a Trump win is increasingly seen as favorable for crypto assets, with many investors expecting reduced regulatory pressures.

The sentiment has led to heightened trading activity and increased confidence in the cryptocurrency market.

Trump is currently polling ahead of Vice President Kamala Harris in several swing states.

New Bitcoin ATH Could Drive Altcoin Prices Higher

Bitcoin’s new ATH is expected to have a ripple effect across the cryptocurrency market, potentially driving altcoin prices higher as well.

Historically, when BTC rallies, other cryptocurrencies often follow suit, as investors seek to capitalize on market momentum.

It is worth noting that in comparison to traditional assets, Bitcoin’s performance continues to stand out.

While gold and stocks have shown more subdued gains in recent months, Bitcoin’s volatility and growth potential attract a unique set of investors seeking high returns.

In a recent report, the Bitcoin Policy Institute argued that Bitcoin could act as a reserve asset to protect against inflation, geopolitical tensions, capital controls, sovereign defaults, banking crises, and international sanctions.

Authored by economist Matthew Ferranti, it highlights Bitcoin’s limited correlation with traditional financial assets, describing it as an “effective portfolio diversifier.”

This distinct lack of correlation, he claims, gives Bitcoin unique value as a reserve asset, particularly for countries looking to reduce dependency on the U.S. dollar.

Conclusion

Bitcoin’s latest ATH comes following a previous record in mid-March 2024 when it reached $73,750.07.

The recent price surge is attributed to various factors, including a substantial influx of institutional investment, particularly from firms like Metaplanet, which has significantly increased its BTC holdings.

Investor sentiment has shifted towards optimism, as indicated by a spike in Google searches for Bitcoin and the Fear and Greed Index moving into the “Extreme Greed” zone.

Analysts believe that the convergence of election uncertainty regarding a potential Trump victory, a favorable seasonal trend, and the “Trump trade” narrative are propelling BTC’s bullish momentum.

Meanwhile, the new ATH is expected to positively impact altcoin prices as well, as historical trends suggest that Bitcoin rallies typically lead to increased interest in other cryptocurrencies.